Whether your business is brand new to processing credit cards or has been doing so for years, there’s a few tips and tricks to lowering your interchange processing fee. Before we get into these, you should first  understand how interchange works so you are better prepared to negotiate with your Merchant Service Provider.

understand how interchange works so you are better prepared to negotiate with your Merchant Service Provider.

How Interchange Works

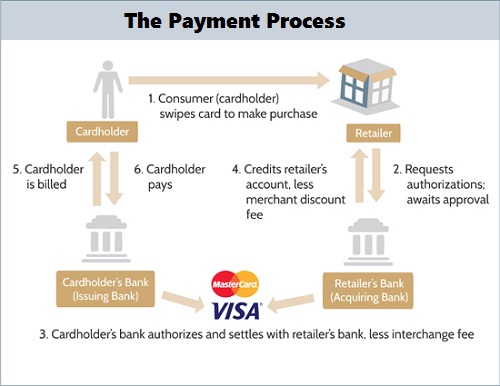

Interchange is the process in which acquirers, card issuers, and the processors manage the fees associated in processing credit and debit cards. Interchange is often referred as the ‘true cost’ of the card, or in other words what it costs the acquiring bank to process transactions. The acquiring bank then charges a fee above interchange to the issuing bank, this fee is often called a ‘discount rate’ and that rate is passed along to the merchant.

So ultimately, the merchant is paying ‘interchange plus’ which is the interchange plus the discount rate that the issuing bank charges. It’s more important to understand that the discount rate will vary depending on what card is accepted and what Merchant Service Provider you choose.

For example, the discount rate for a debit card is usually lower than it is for a corporate credit card. Likewise, one merchant service provider might charge a much higher discount rate than another. Knowing this ahead of time will give you an advantage when negotiating a better contract.

Use a Payment Consultant or Shop Around

If you are already processing credit cards your best option is to use a consulting firm that will do the work for you. Send them your last three months worth of processing statements so they can do one of two things. They can point you to the best service provider based on your situation. Don’t worry if you’re in a contract, many providers will cover the cost of your cancellation fee.

Even better they can renegotiate your fees with your current provider so that you don’t have to go through the painful process of switching vendors yet still benefit from the savings. Their fees are normally tied to your monthly savings so the more money they save you the more money they make.

If you are new to credit card processing you can still shop around and use different quotes as leverage against other vendors. While it might not be a dramatic change, you will still get a good idea of what the average discount rate is and have a better understanding of how interchange plus works.

Ask Questions

Usually, the discount rate a merchant service provider originally quotes will not be the lowest they can go. Simply ask, “can you do any better?” Smart business people won’t give you anymore than you ask for. You’ll be surprised how much a simple question might be able to save you. Most providers have a ‘target discount rate’ and a ‘rock-bottom discount rate’ that they will use in order to win your business.

If you don’t ask they will never bring it up. As mentioned earlier, the discount rate will differ from card to card so also be sure to ask which card(s) the rate applies to. If your customers typically pay you with their company or purchasing card, that enticing discount rate you were quoted will not even apply.

Make sure to ask what the total discount rate is for the cards you’ll be accepting the most, and don’t be fooled with a discount rate for a card that’s not applicable for your business. This is key to saving money when accepting B2B payments. You can even take your savings to a deeper level by learning about level 2 and level 3 data.