There have been a few recent changes that affect the way a business can process b2b transactions that could drastically cut b2b payment processing fees. First, if your business hasn’t looked into level 3 data rates, it might be time to start.

that affect the way a business can process b2b transactions that could drastically cut b2b payment processing fees. First, if your business hasn’t looked into level 3 data rates, it might be time to start.

Earlier last year, Visa introduced a program that allows Corporate Cards to qualify for Level 3 Interchange rates. Lets take a look at Visa’s Interchange rates for cards that apply:

- Commercial Level III 1.95% + $0.10

- Commercial Level II 2.05% + $0.10

- Commercial Business-to-Business 2.40% + $0.10

- Commercial Card Not Present 2.65% + $0.10

Businesses using an interchange plus program could potentially save 45 to 70 basis points by qualifying their cards for Level 3 interchange rates. Businesses processing b2b payments on a tiered structure could save even more. This could easily eliminate any non-qualified surcharges for accepting Corporate Cards as well as lower the overall processing fee.

Businesses looking to take advantage of these savings by switching to level 3 data should make sure they have the proper processing software. If your business is set up with a business-to-consumer portal for processing b2b transactions, it’ll be time to upgrade. Luckily, there are level 3 payment portals that make processing level 3 transactions easier than ever. Although level 3 data requires more information, there’s software that will walk you through it, and even alerts you if information is missing. Having the proper software will ensure that all eligible transactions will be processed as level 3.

Master Card has also introduced a new interchange plan for small businesses called the Small Business Spend Processing (SBSP). This plan is based around the annual monetary amount a business processes. Here’s how it breaks down:

- $25,000-49,999 = Business level 2

- $50,000-99,999 = Business level 3

- $100,000+ = Business level 4

Note that Business Level 2 and 3 are not the same as Data Level 2 and 3. In this plan, the interchange rate is determined based on what Business Level a business fits into. Using the MasterCard Elite Worldcard under business level 3 as an example below:

- Business level 3, World Elite Data Rate I, 2.86%

- Business level 3, World Elite Data Rate II, 2.16%

- Business level 3, World Data Elite Rate III, 1.96%

We can see that if a business is processing between $50,000-99,999 per year, the level of data that’s captured really makes a difference. If a business is processing level 1 data, switching to level 2 could cut their b2b processing fee by 70 basis points. Switching to level 3 data could cut their b2b processing fee by 90 basis points. Moreover, any business still in a tiered structure could potentially save the most. Just like the Visa example earlier, this could eliminate any non-qualified surcharges as well as lower the overall b2b processing fee.

It bears repeating, if any business looking to make the switch to accepting level 3 or even level 2 data, there needs to be proper payment technology in place. Making the transition can be easy, but it’s good to have some help. Make sure that your Merchant Service Provider gives your business the correct tools in order to process level 2 and 3 data and cut b2b processing fees.

Will the business be taking mostly consumer credit and debit cards or will the majority be corporate and government cards? Knowing these facts ahead of time will save a lot of headaches down the road.

Will the business be taking mostly consumer credit and debit cards or will the majority be corporate and government cards? Knowing these facts ahead of time will save a lot of headaches down the road.

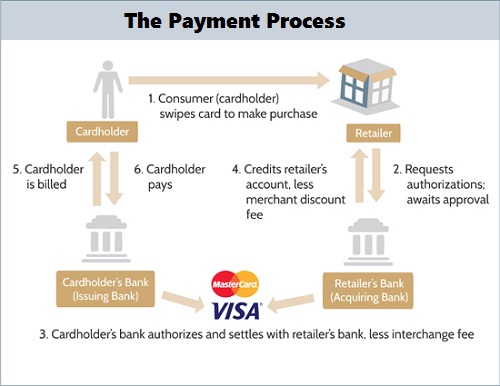

understand how interchange works so you are better prepared to negotiate with your Merchant Service Provider.

understand how interchange works so you are better prepared to negotiate with your Merchant Service Provider.